Note: Please check your Spam or Junk folder, in case you didn't receive the email with verification code.

Non-Linear: Random Order

Course Description

This course is designed to make students with a comprehensive understanding of accounting and taxation principles as they are applied to businesses. The course will cover various topics about accounting and taxation such as financial statements, bookkeeping, payroll, taxes and auditing. During the course, students will learn professional methods of preparing financial statements including balance sheets, income statements and cash flow statements. They will also learn how to maintain accurate records of financial transactions through bookkeeping and understand how to reconcile accounts.

The course will cover the basics of payroll accounting including how to calculate and record payroll taxes and withholding. Students will also learn about different types of business taxes and how to prepare tax returns. The course will also delve into auditing principles including how to conduct internal audits and prepare for external audits. Students will learn how to identify and correct errors in financial records and how to ensure compliance with tax regulations.

Objectives

• The course aims to provide students with a comprehensive understanding of financial statements such as income statements, balance sheets and cash flow statements.

• Students should be able to analyze and interpret these statements to make informed decisions.

• The course aims to familiarize students with tax laws and regulations including federal, state and local tax laws.

• Students should be able to understand tax codes, exemptions, deductions and credits and apply them to real-life business scenarios.

• The course aims to provide students with an understanding of basic bookkeeping and accounting principles.

• Students should be able to maintain financial records including transactions, ledgers and journals.

• The course aims to teach students how to prepare budgets and forecasts for a business.

• Students should be able to analyze financial data and create financial plans to achieve business goals.

• The course aims to provide students with knowledge of auditing and internal control procedures.

• Students should be able to identify potential fraud and internal control weaknesses and design controls to mitigate these risks.

• The course aims to familiarize students with accounting software used in businesses today.

• Students should be able to navigate and use accounting software to manage financial data and create reports.

Who Should Take This Course?

• Business owners and entrepreneurs who owns a business or planning to start one. This course will help you manage your finances better and make informed decisions.

• Accounting and finance professionals who are working in the accounting or finance industry, this course will provide you with the knowledge and skills needed to excel in your role.

• Students who are studying business, accounting or finance taking this course will supplement your learning and provide you with a solid foundation in accounting and taxation.

• The course is suitable for anyone who wants to gain a better understanding of business accounting and taxation regardless of their background or experience.

. 1.1 Definition and Importance of Accounting and Taxation

1.1 Definition and Importance of Accounting and Taxation

1.2 Classification of Accounting

1.2 Classification of Accounting

1.3 Accounting and Taxation Principles and Concepts

1.3 Accounting and Taxation Principles and Concepts

INTRODUCTION TO BUSINESS ACCOUNTING AND TAXATION - ASSESSMENT

5 Questions

INTRODUCTION TO BUSINESS ACCOUNTING AND TAXATION - ASSESSMENT

5 Questions

2.1 Overview of Financial Accounting

2.1 Overview of Financial Accounting

2.2 Financial Statements: Balance Sheet, Income Statement, Statement of Cash Flows

2.2 Financial Statements: Balance Sheet, Income Statement, Statement of Cash Flows

2.3 Accounting Cycle: Journal Entries, Ledger Accounts, Trial Balance, Adjusting Entries, Financial Statements

2.3 Accounting Cycle: Journal Entries, Ledger Accounts, Trial Balance, Adjusting Entries, Financial Statements

2.4 Financial Analysis and Interpretation

2.4 Financial Analysis and Interpretation

2.5 GAAP

2.5 GAAP

FINANCIAL ACCOUNTING - ASSESSMENT

5 Questions

FINANCIAL ACCOUNTING - ASSESSMENT

5 Questions

3.1 Overview of Managerial Accounting

3.1 Overview of Managerial Accounting

3.2 Cost Behavior and Cost-Volume Profit Analysis

3.2 Cost Behavior and Cost-Volume Profit Analysis

3.3 Budgeting and Forecasting

3.3 Budgeting and Forecasting

3.4 Cost Accounting Systems: Job Order Costing, Process Costing, Activity-based Costing

3.4 Cost Accounting Systems: Job Order Costing, Process Costing, Activity-based Costing

3.5 Performance Measurement and Evaluation

3.5 Performance Measurement and Evaluation

MANAGERIAL ACCOUNTING - ASSESSMENT

5 Questions

MANAGERIAL ACCOUNTING - ASSESSMENT

5 Questions

4.1 Overview of Taxation

4.1 Overview of Taxation

4.2 Types of Taxes: Income Tax, Sales Tax, Property Tax, Excise Tax, Payroll Tax

4.2 Types of Taxes: Income Tax, Sales Tax, Property Tax, Excise Tax, Payroll Tax

4.3 Tax Planning and Compliance

4.3 Tax Planning and Compliance

4.4 Tax Laws and Regulations

4.4 Tax Laws and Regulations

4.5 International Taxations

4.5 International Taxations

TAXATION - ASSESSMENT

5 Questions

TAXATION - ASSESSMENT

5 Questions

5.1 Overview of Ethics in Accounting and Taxation

5.1 Overview of Ethics in Accounting and Taxation

5.2 Professional Conduct and Responsibility

5.2 Professional Conduct and Responsibility

5.3 Code of Ethics and Ethical Decision-making

5.3 Code of Ethics and Ethical Decision-making

5.4 Ethical Issues and Dilemmas in Accounting and Taxation

5.4 Ethical Issues and Dilemmas in Accounting and Taxation

ETHICS IN ACCOUNTING AND TAXATION - ASSESSMENT

5 Questions

ETHICS IN ACCOUNTING AND TAXATION - ASSESSMENT

5 Questions

6.1 Overview of Information Technology in Accounting and Taxation

6.1 Overview of Information Technology in Accounting and Taxation

6.2 Accounting and Taxation Software

6.2 Accounting and Taxation Software

6.3 Electronic Data Interchange (EDI) and E-commerce

6.3 Electronic Data Interchange (EDI) and E-commerce

6.4 Security and Privacy Issues in Accounting and Taxation

6.4 Security and Privacy Issues in Accounting and Taxation

INFORMATION TECHNOLOGY IN ACCOUNTIING AND TAXATION - ASSESSMENT

5 Questions

INFORMATION TECHNOLOGY IN ACCOUNTIING AND TAXATION - ASSESSMENT

5 Questions

Final Assessment

20 Questions

Final Assessment

20 Questions

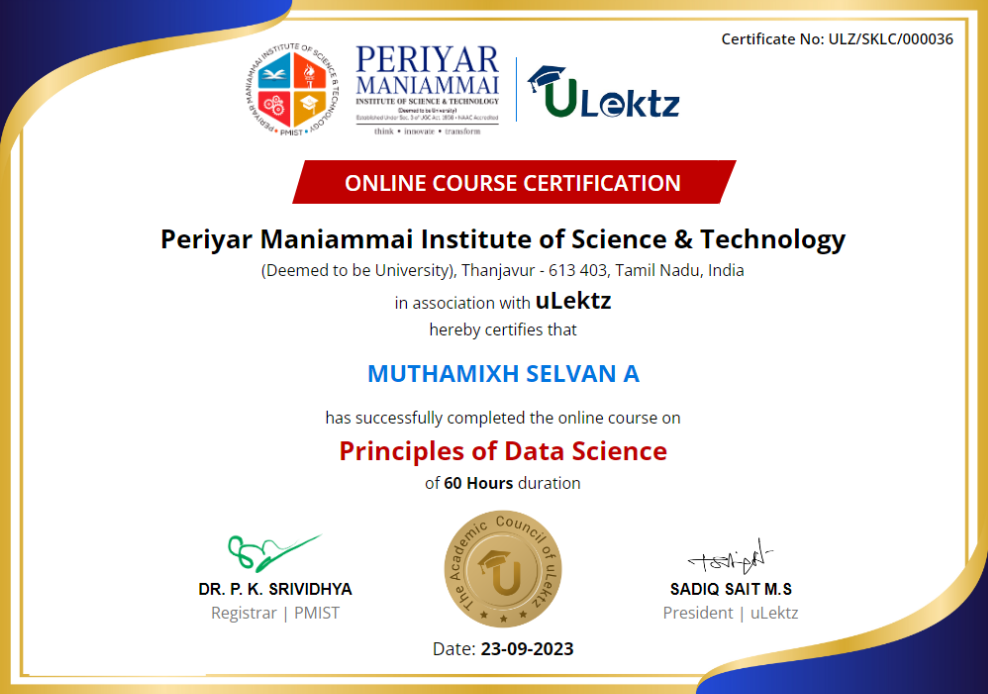

The certificate issued for the Course will have

Only the e-certificate will be made available. No Hard copies. The certificates issued by Periyar Maniammai Institute of Science and Technology. can be e-verifiable at www.ulektzskills.com/verify.

60 hours Learning Content

60 hours Learning Content 100% online Courses

100% online Courses English Language

English Language Certifications

Certifications