Note: Please check your Spam or Junk folder, in case you didn't receive the email with verification code.

Non-Linear: Random Order

Course Description

Course Objectives

Upon successful completion of this certification course, participants will be able to

• Understand the fundamental concepts and principles of GST.

• Navigate the GST registration process and compliance requirements.

• Comprehend the nuances of GST rates, classifications and exemptions.

• Master GST return filing, payment mechanisms and e-way bill generation.

• Effectively utilize Input Tax Credit (ITC) and handle Reverse Charge Mechanism (RCM).

• Address common GST compliance issues and challenges.

• Stay updated with the latest developments and amendments in GST law.

Who is this Course For

• Tax professionals including consultants, advisors and chartered accountants, seeking specialization in GST.

• Finance and accounting professionals such as analysts, managers and auditors, aiming to grasp GST's financial impact.

• Business owners, entrepreneurs and startups needing GST compliance expertise.

• Legal and compliance experts including lawyers and officers ensuring GST compliance.

• Students and aspiring professionals in finance, accounting, law or taxation.

• Government employees, tax officers and public sector workers administering GST regulations.

• Procurement and supply chain professionals navigating GST's influence on operations.

• E-commerce professionals handling GST complexities in online sales.

• Consultants and advisors providing GST guidance to clients.

• Anyone intrigued by taxation, economics or GST's functioning, eager to broaden their knowledge.

1.1Overview of GST

1.1Overview of GST

1.2 Historical Background

1.2 Historical Background

1.3 Objectives and Advantages of GST

1.3 Objectives and Advantages of GST

1.4 Comparison with The Previous Tax System

1.4 Comparison with The Previous Tax System

INTRODUCTION TO GST - Assessment

10 Questions

INTRODUCTION TO GST - Assessment

10 Questions

2.1 Eligibility and Requirements for GST Registration

2.1 Eligibility and Requirements for GST Registration

2.2 The Registration Process

2.2 The Registration Process

2.3 Amendments and Cancellation of Registration

2.3 Amendments and Cancellation of Registration

2.4 GST Compliance and Record-keeping

2.4 GST Compliance and Record-keeping

GST REGISTRATION AND COMPLIANCE - Assessment

7 Questions

GST REGISTRATION AND COMPLIANCE - Assessment

7 Questions

3.1 Understanding the Concept of Supply

3.1 Understanding the Concept of Supply

3.2 Types of Supplies (Taxable, Exempt, Zero-rated)

3.2 Types of Supplies (Taxable, Exempt, Zero-rated)

3.3 Input Tax Credit (ITC) Mechanism

3.3 Input Tax Credit (ITC) Mechanism

3.4 Place and Time of Supply Rules

3.4 Place and Time of Supply Rules

GST CONCEPTS AND BASICS- Assessment

8 Questions

GST CONCEPTS AND BASICS- Assessment

8 Questions

4.1 GST Rate Structure

4.1 GST Rate Structure

4.2 Classification of Goods and Services

4.2 Classification of Goods and Services

4.3 Harmonized System of Nomenclature (HSN) and Service Accounting Codes (SAC)

4.3 Harmonized System of Nomenclature (HSN) and Service Accounting Codes (SAC)

4.4 Factors Influencing GST Rates

4.4 Factors Influencing GST Rates

GST RATES AND CLASSIFICATION - Assessment

8 Questions

GST RATES AND CLASSIFICATION - Assessment

8 Questions

5.1 Filing of GST returns (GSTR-1, GSTR-3B, etc.)

5.1 Filing of GST returns (GSTR-1, GSTR-3B, etc.)

5.2 Due Dates and Penalties for Late Filing

5.2 Due Dates and Penalties for Late Filing

5.3 GST Payment Mechanisms

5.3 GST Payment Mechanisms

5.4 E-way Bills and Their Importance

5.4 E-way Bills and Their Importance

GST RETURNS AND PAYMENT - Assessment

8 Questions

GST RETURNS AND PAYMENT - Assessment

8 Questions

6.1 Input Tax Credit (ITC) Eligibility and Conditions

6.1 Input Tax Credit (ITC) Eligibility and Conditions

6.2 Reverse Charge Mechanism (RCM)

6.2 Reverse Charge Mechanism (RCM)

6.3 Valuation Under GST

6.3 Valuation Under GST

6.4 Compliance Issues and Common Challenges

6.4 Compliance Issues and Common Challenges

INPUT TAX CREDIT AND COMPLIANCE ISSUES - Assessment

8 Questions

INPUT TAX CREDIT AND COMPLIANCE ISSUES - Assessment

8 Questions

7.1 Special Provisions for Specific Industries

7.1 Special Provisions for Specific Industries

7.2 GST and International Trade (Export and Import)

7.2 GST and International Trade (Export and Import)

7.3 Recent Developments and Updates in GST law

7.3 Recent Developments and Updates in GST law

7.4 GST Technology

7.4 GST Technology

ADVANCED GST TOPICS - Assessment

8 Questions

ADVANCED GST TOPICS - Assessment

8 Questions

Final Assessment

20 Questions

Final Assessment

20 Questions

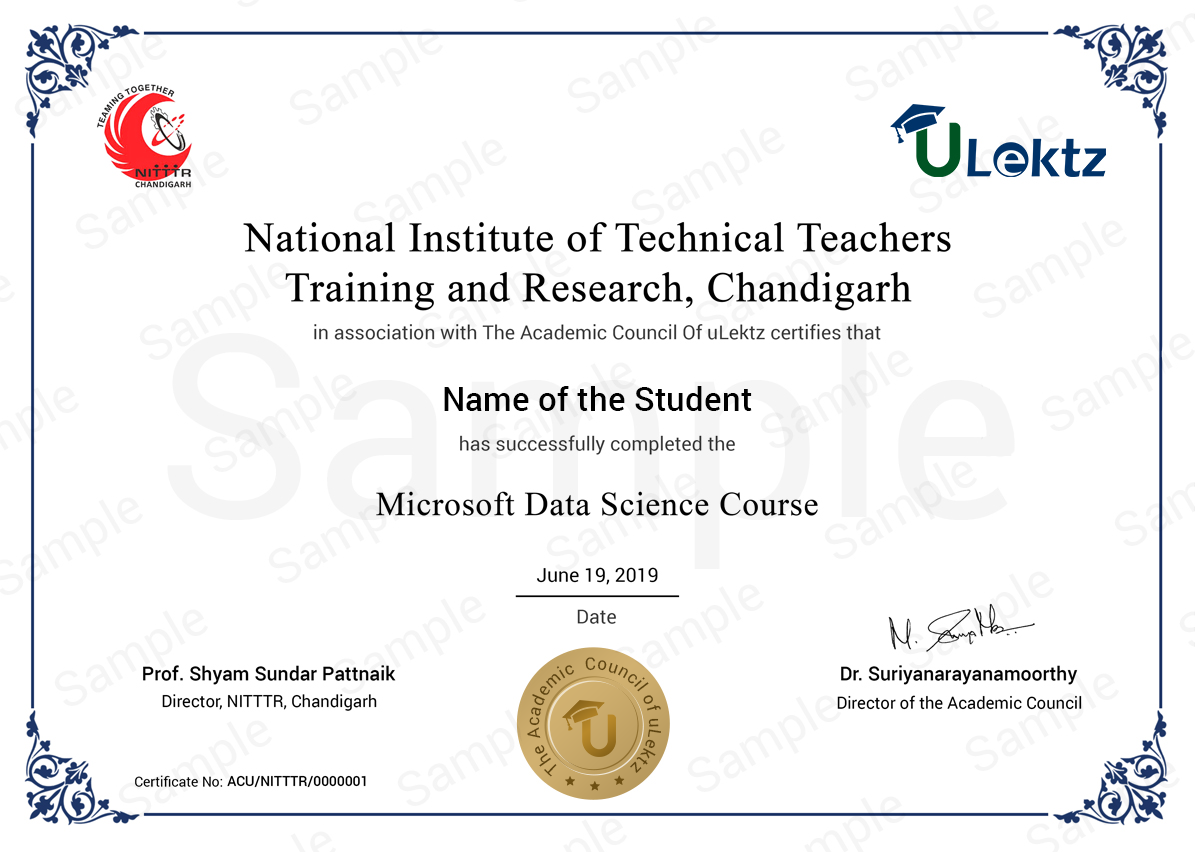

The certificate issued for the Course will have

Only the e-certificate will be made available. No Hard copies. The certificates issued by The Academic Council of uLektz. can be e-verifiable at www.ulektzskills.com/verify.

60 hours Learning Content

60 hours Learning Content 100% online Courses

100% online Courses English Language

English Language Certifications

Certifications